Thailand says it has asked Myanmar junta to reduce violence

European court ruling puts cautious Swiss in climate bind

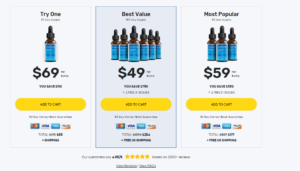

Keto BHB Salts Reviews (NTX KETO BHB GUMMIES) Metabolix Labs Keto ACV Gummies for Trim Tummy

Featured Posts

We must stop children getting addicted to online gaming

How Matches Lifestyle is investing in the designers of tomorrow

In a circular economy for fashion, clothes, shoes, and accessories are used more, are made from safe and renewable materials, and are made to be made again.

How Matches Lifestyle is investing in the designers of tomorrow

In a circular economy for fashion, clothes, shoes, and accessories are used more, are made from safe and renewable materials, and are made to be made again.

Fashion businesses are no longer a worthwhile investment

The scientists spoke to local people, who relied on the filthy streams and rivers for their water supply, and learned that waste from textile factories was contaminating the waterways.

Fashion businesses are no longer a worthwhile investment

The scientists spoke to local people, who relied on the filthy streams and rivers for their water supply, and learned that waste from textile factories was contaminating the waterways.

Florida Man Who Drove Into Protesters Gets 6 Years in Prison

Dozens of protesters sustained serious injuries from teargas, rubber bullets, stun grenades, used by police to disperse crowds during the Dark Holiday Protest.